Weekly market review: Sensex, Nifty post biggest loss in 2 years

ANI

18 Jun 2022, 14:48 GMT+10

By Gyanendra Kumar KeshriMumbai (Maharashtra) [India], June 18 (ANI): Sharp increase in interest rates by the US Federal Reserve and other central banks have battered equities markets across the world with India's key indices Sensex and Nifty slumping by more than 5 per cent during the week, posting their biggest weekly loss in more than two years.

The 30 stock SP BSE Sensex slumped by 2,943.02 points or 5.41 per cent during the week ended Friday while the Nifty 50 of the National Stock Exchange crashed by 908.3 points or 5.6 per cent. This is the biggest weekly loss in the country's benchmark indices since May 2020.

The stock markets suffered from a triple blow during the week - inflationary pressure, fears of global recession, and a sharp increase in interest rates by the US Federal Reserve.

"Markets reacted to increased risks of a global recession and persistently higher inflation. Inflation has clearly taken centre stage and is one of the key factors driving monetary policy stance and impacting the direction of equity markets," said Shibani Kurian, Senior EVP and Head- Equity Research, Kotak Mahindra Asset Management Company.

The week started with global selloffs. The benchmark Sensex crashed 1456.74 points or 2.68 per cent on Monday, the first trading day of the week. The selloffs intensified after the US Federal Reserve hiked the interest rate by 75 basis points or 0.75 per cent to 1.5 per cent. This is the highest increase in interest rate by the Fed since 1994.

The Fed action came after the US CPI inflation surged to 8.6 per cent year-on-year in May, the highest level in 40 years.

The US Fed has started quantitative tightening and indicated for tight monetary policy stance in order to control inflation.

Central banks across the world are struggling to control inflation. The Reserve Bank of India (RBI) has hiked the policy repo rate by 90 basis points or 0.90 per cent since May.

On June 8, the RBI Monetary Policy Committee (MPC) voted unanimously to increase the policy repo rate by 50 basis points to 4.90 per cent. In its off-cycle monetary policy review in the first week of May the RBI had hiked the policy repo rate by 40 basis points.

In the monetary policy review early this month the RBI raised the inflation forecast for the current financial year to 6.7 per cent from its earlier projection of 5.7 per cent.

High inflation is expected to derail economic recovery and put pressure on the company's earnings and profits.

Major stock market indices have either entered the bear territory or are near it. In the US, the SP 500 and Nasdaq indices have slumped more than 20 per cent from their peaks and are already in the bear territory.

The Indian stock market's key indices Sensex and Nifty have crashed more than 17 per cent from their all-time intraday high of 62,245 points reached in October 2021. A market is called in bear territory when the key indices drop 20 per cent from their peak. It acts as a psychological factor and often leads to further slumps in the market as large investors reduce their exposure to equities.

"There are many moving parts which are likely to determine the course of movement for equity markets. In the near term, some of the key factors that are to be important to track include inflation and monetary policy, trajectory of commodity price movement especially oil, any development on the Ukraine-Russia war and outlook on domestic demand and corporate earnings," said Kurian.

The Sensex and Nifty have recorded six consecutive sessions of loss. The Sensex closed 135.37 points or 0.26 per cent down at 51,360.42 points on Friday. The Sensex had lost 1045.60 points or 1.99 per cent on Thursday. The Sensex had slipped by 152.18 points or 0.29 per cent on Wednesday. The index had slumped by 153.13 points, 1456.74 points and 1016.84 points in the previous three sessions, respectively.

Nifty 50 of the National Stock Exchange closed 67.10 points or 0.44 per cent down at 15,293.50 points on Friday. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Caribbean Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Caribbean Herald.

More InformationBusiness

SectionBP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...

FedEx, UPS step up as Canada Post loses market share in strikes

OTTAWA, Canada: With Canada Post struggling to maintain operations amid labour unrest, rivals like FedEx and UPS are stepping in to...

U.S. stocks steady Tuesday despite tariffs turmoil

NEW YORK, New York - U.S. and global markets showed a mixed performance in Tuesday's trading session, with some indices edging higher...

Beijing blamed for covert disinformation on French fighter jet Rafale

PARIS, France: French military and intelligence officials have accused China of orchestrating a covert campaign to damage the reputation...

Birkenstock steps up legal battle over fakes in India

NEW DELHI, India: Birkenstock is stepping up its efforts to protect its iconic sandals in India, as local legal representatives conducted...

Beijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

Latin America

SectionJAMAICA-MONTEGO BAY-CARICOM-CONFERENCE-CLOSING

(250709) -- MONTEGO BAY, July 9, 2025 (Xinhua) -- Participants attend a press conference of the closing ceremony of the 49th Regular...

"We are thrilled, excited": Indian diaspora on PM Modi's visit to Namibia

Windhoek [Namibia], July 9 (ANI): The Indian diaspora in Namibia expressed immense excitement and anticipation as Prime Minister Narendra...

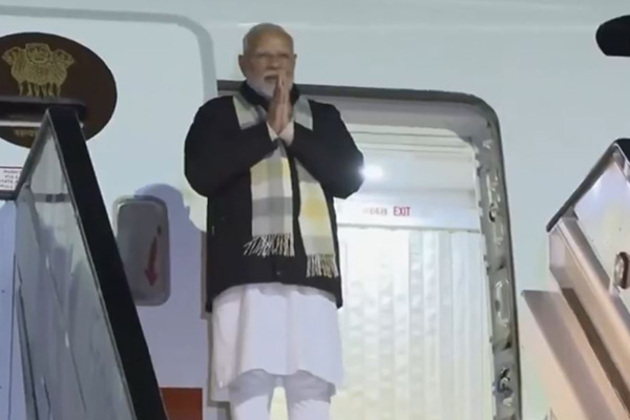

PM Modi arrives in Namibia for first-ever visit, to hold bilateral talks with President Nandi-Ndaitwah

Windhoek [Namibia], July 9 (ANI): Prime Minister Narendra Modi arrived in Windhoek, the capital of Namibia, on Wednesday morning (local...

"Super Premium Frequent Flier PM is in Namibia today": Jairam Ramesh

New Delhi [India], July 9 (ANI): Congress General Secretary Incharge of Communication, Jairam Ramesh on Wednesday launched a fresh...

Explainer: Where do things stand now as Trump prolongs tariff pause?

The delay adds yet another twist to Trump's original 90 deals in 90 days promise -- so far yielding only two vague trade agreements...

"Symbol of Bharat's growing global stature": UP CM Yogi Adityanath on PM Modi receiving Brazil's top honour

Lucknow (Uttar Pradesh) [India], July 9 (ANI): Uttar Pradesh Chief Minister Yogi Adityanath on Wednesday congratulated Prime Minister...